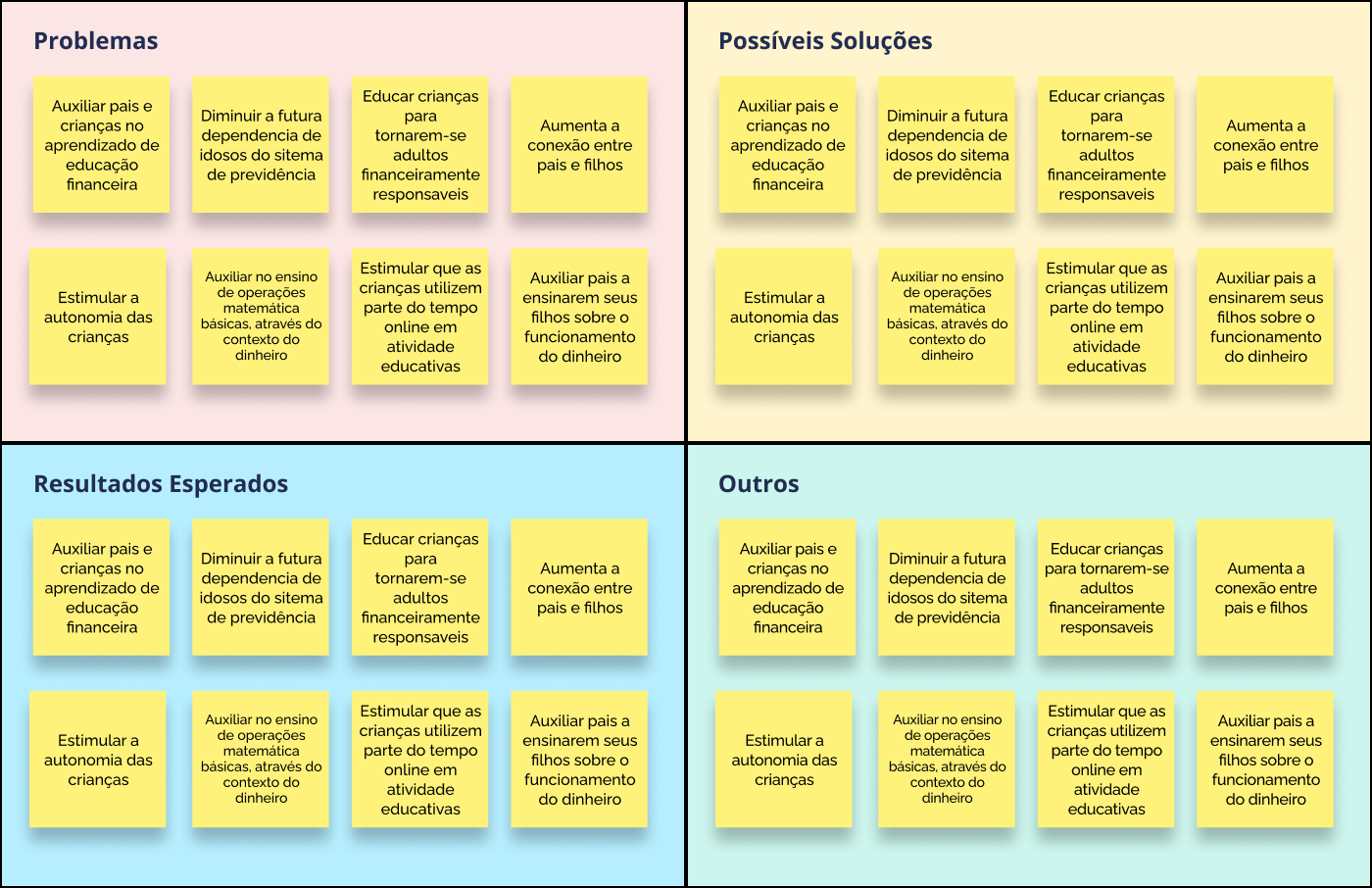

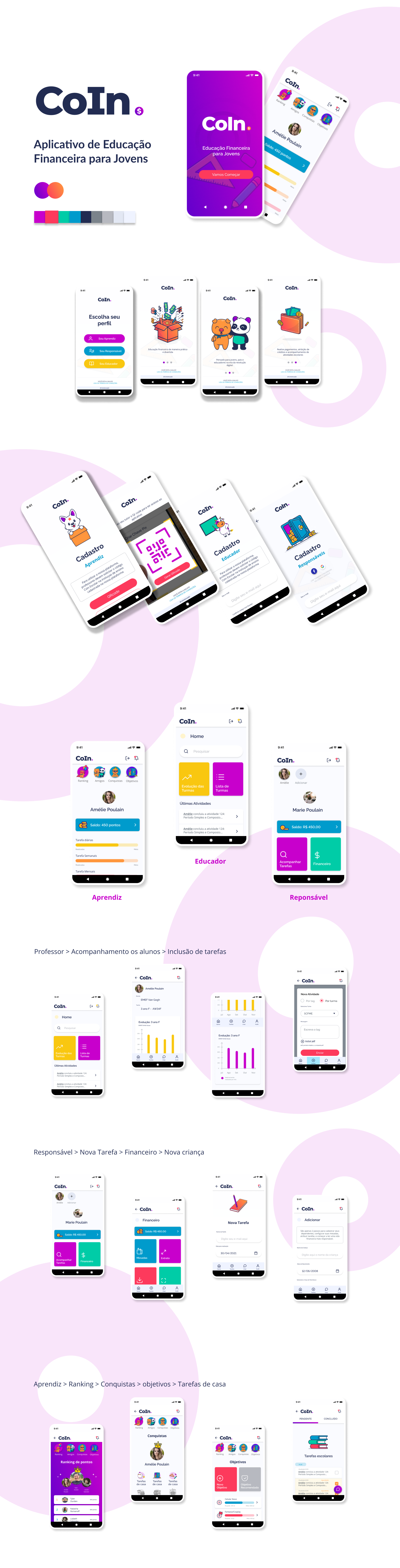

Based on all the information gathered in this report and mainly drawing from the readings of D’aquino (2008) and Cerbasi (2011), the final strategy for the project has been established.

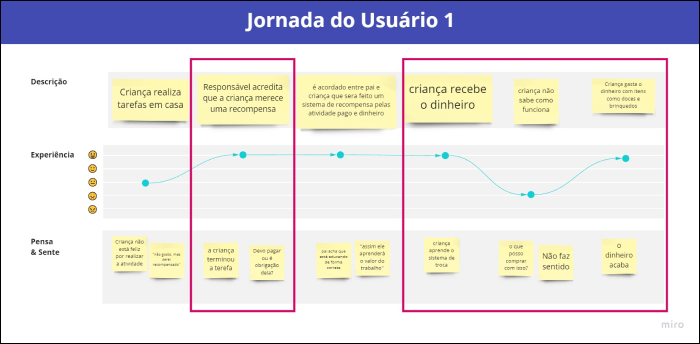

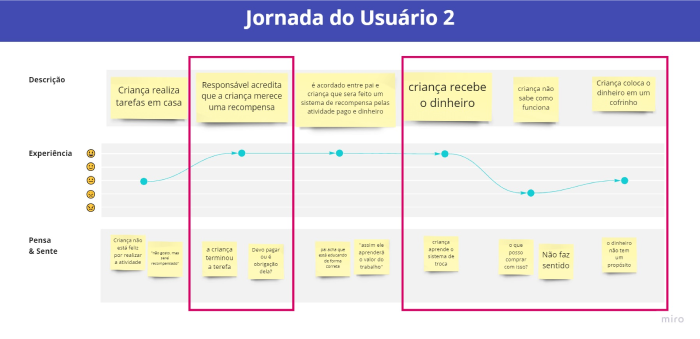

The method focuses on raising awareness among parents about the importance of teaching specific financial skills at each stage of childhood. For children aged 2 to 10, basic competencies are developed, including financial understanding, budget limits, moderate independence, and basic mathematical notions.

Pre-adolescents receive emphasis on promoting independence and financial responsibility, introducing allowances as incentives. The method maintains a non-childish approach, encourages saving, and sets future planning goals.

Rewards are tied to significant achievements, valuing the present over monetary value. Principles include the appreciation of achievements, selective celebration, budget awareness, and the development of negotiation skills and financial balance.

Additionally, the method proposes the adoption of daily habits, learning through fun, positive examples, teaching with care, organization, discipline, conscious shopping, patience, and not considering children as investments. Piggy banks are encouraged as a positive practice.